New Delhi: ICICI Bank account holders will have to pay more for transactions from December 15, 2019. The private bank has stated on its website that it is all set to hike deposit and withdrawal charges on all savings accounts transactions. Also, it will charge customers a fixed amount for transactions made beyond a certain limit.

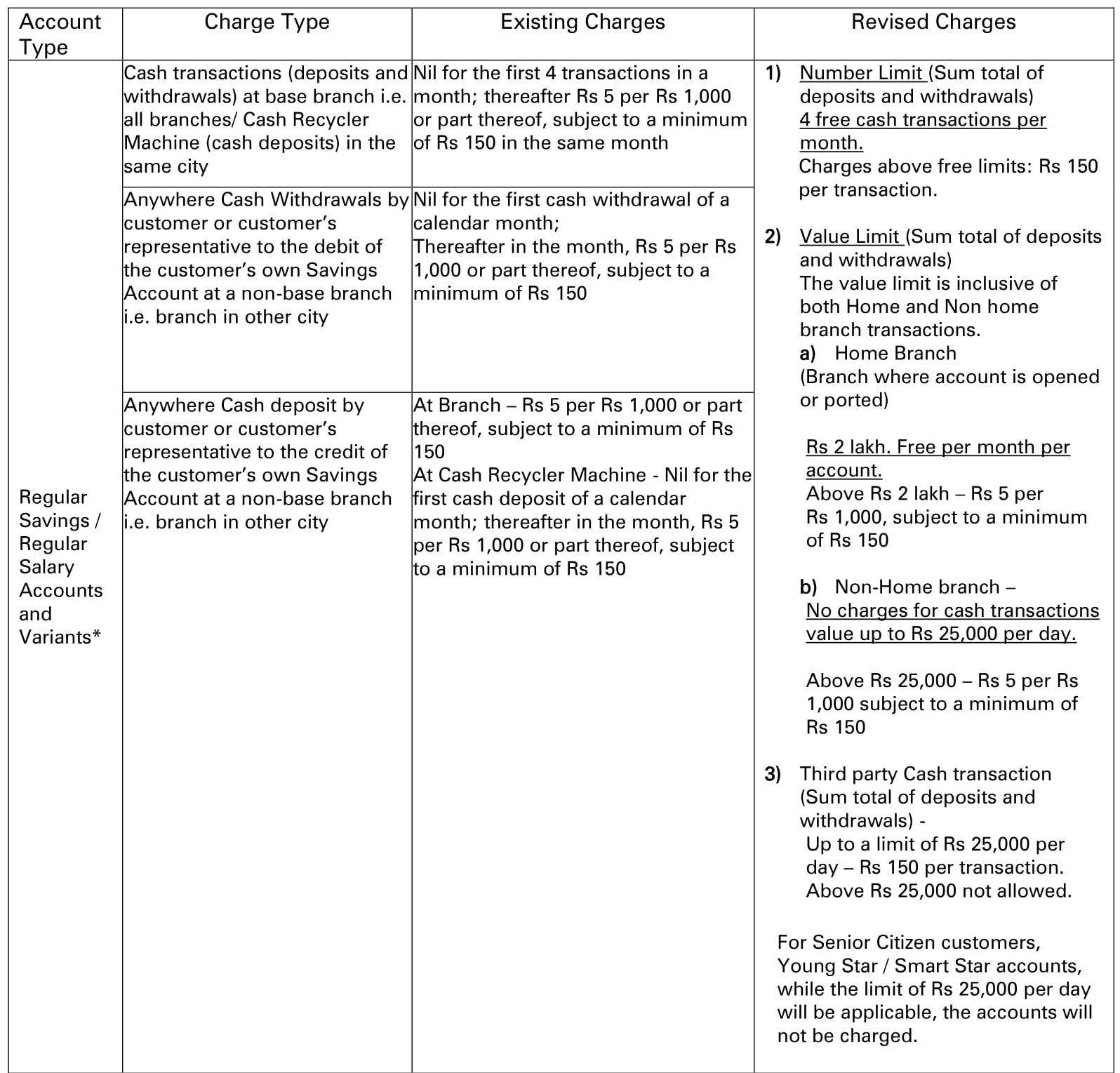

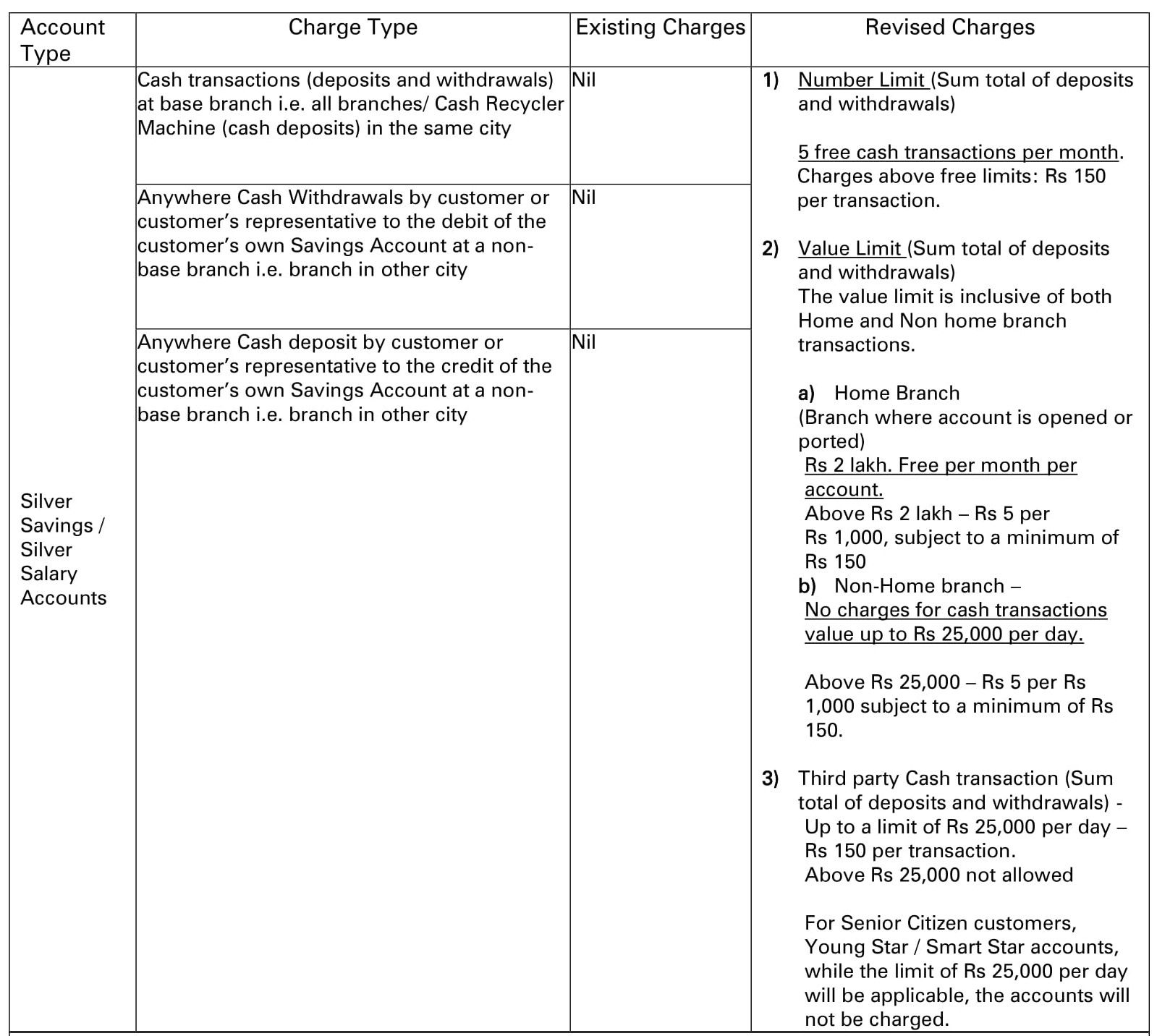

After the implementation of the new charges, the customers will be allowed to make four free cash transactions per month and a charge of Rs 150 per transaction will be levied on any transaction after that. The customers will be allowed to deposit or withdraw up to Rs 2 lakh from their home branch without any fee i.e. no charges will be levied for transactions up to Rs 2 lakh.

For transactions above Rs 2 lakh, the customers will have to pay Rs 5 per Rs 1,000, subject to a minimum of Rs 150. The bank notification stated, “Home Branch (Branch where the account is opened or ported) Rs 2 lakh. Free per month per account. Above Rs 2 lakh – Rs 5 per Rs 1,000, subject to a minimum of Rs 150.”

For the deposits and withdrawals made at non-home branch, no charges will be levied on transactions up to Rs 25,000 per day. Beyond that limit, the customers will have to pay the same amount. “No charges for cash transactions value up to Rs 25,000 per day. Above Rs 25,000 – Rs 5 per Rs 1,000 subject to a minimum of Rs 150,” the website mentioned.

In the case of third party transactions, customers will have to pay Rs 150 per transaction with a limit of Rs 25,000 per day. Additionally, the bank won’t allow transactions above Rs 25,000.

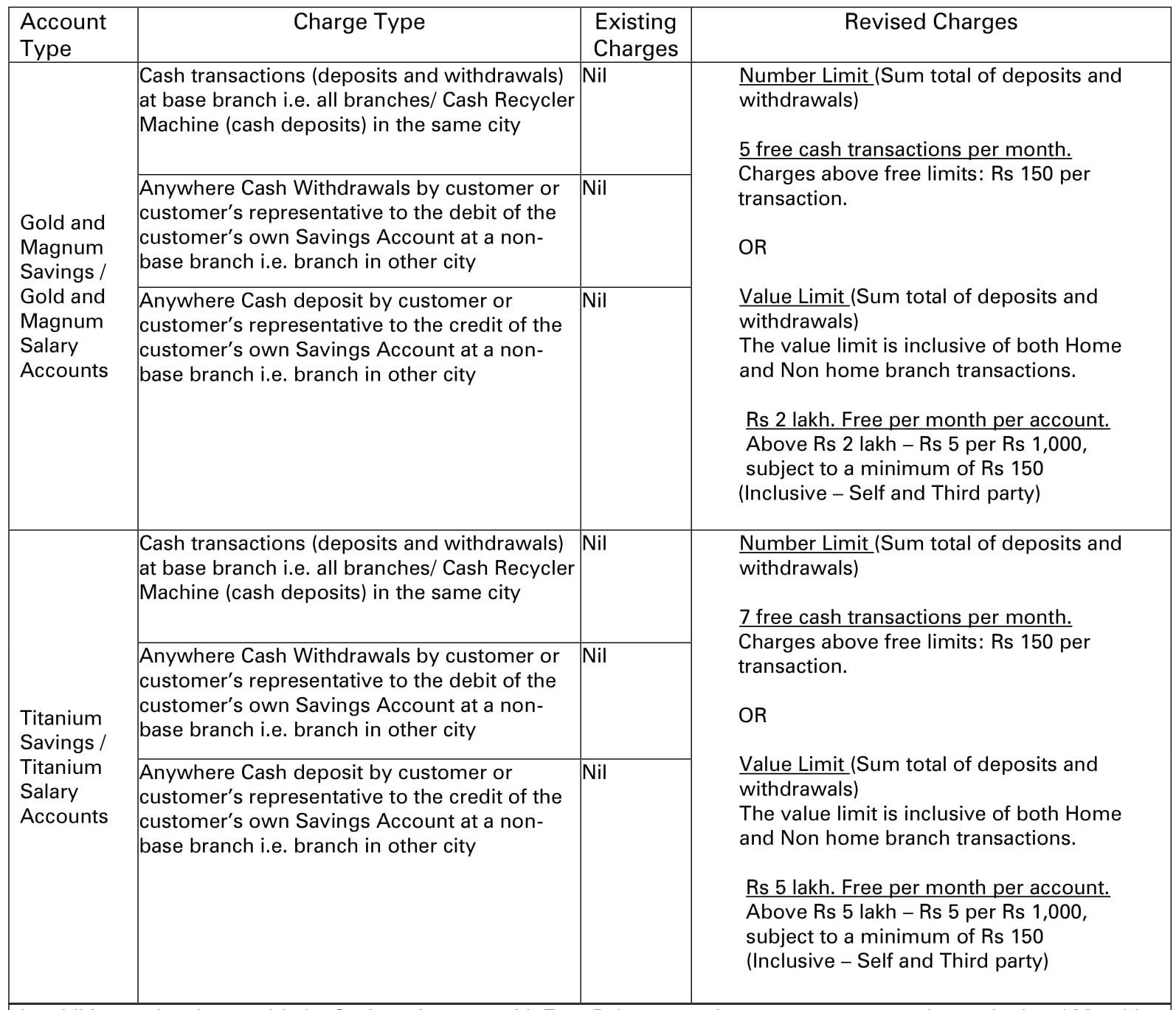

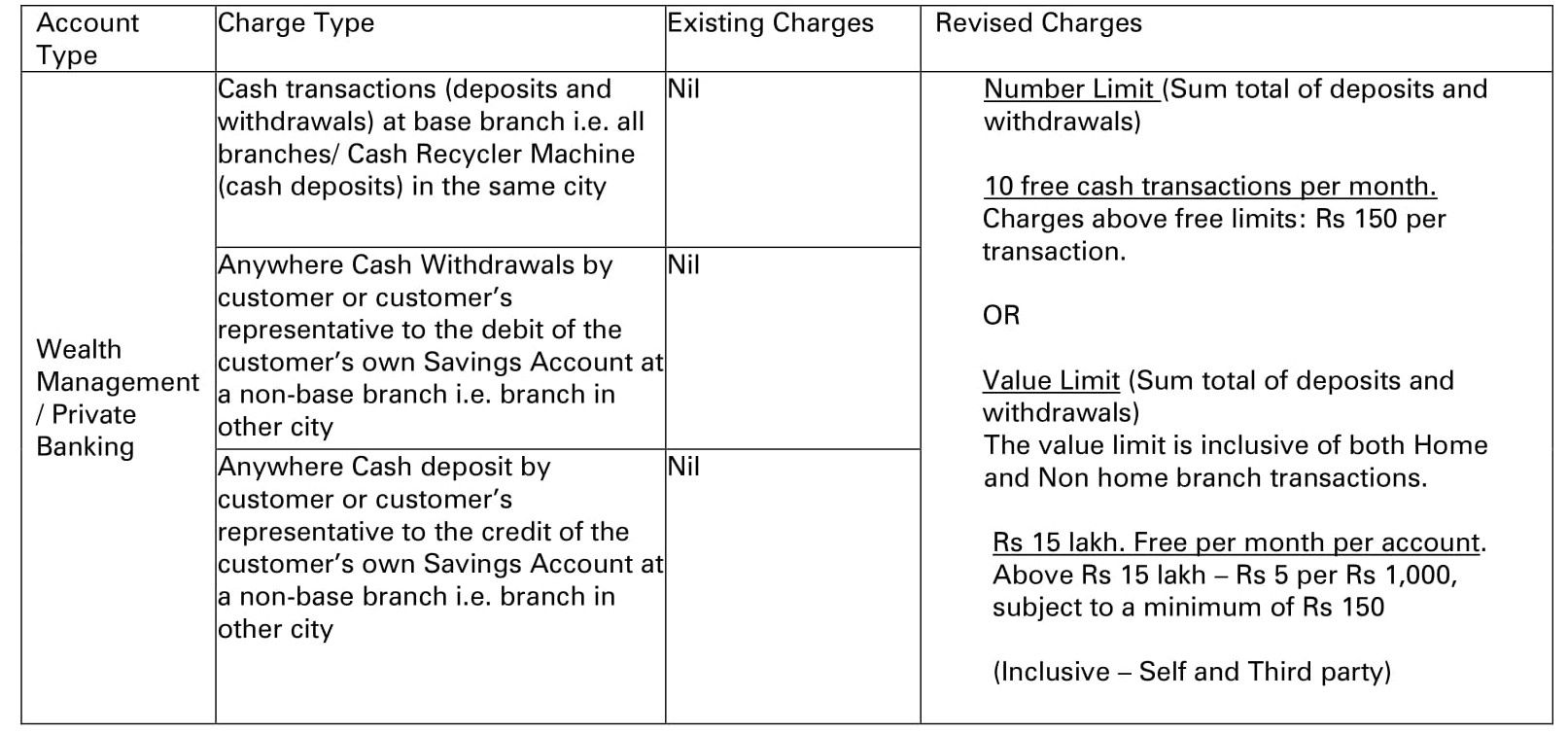

“Keeping in mind the needs of our Savings Accounts customers, we will continue to keep a certain number of cash transactions free at our branches as per the type of Savings Account of the customer with us. Accordingly, the charges on Cash transactions have been revised as per the below grid with effect from Dec 15, 2019,” the bank stated.

Source:- timesnownews